Two More Wealth Myths

Wealth Myth #10: The Search for the Magic Bullet Myth

Magic Bullet - something that cures without causing harmful side effects.

I always tell successful folks who seek me out for help, there is nothing I (or anyone) can offer you that doesn’t have side effects.

Do you believe that?

No matter what you’ve heard, no matter what others have told you, there is nothing you can do, legally, financially, or health-wise that doesn’t have side effects.

That’s not the worst of it.

What’s worse than side effects?

Tactical Interactions.

If you went to a doctor, and they prescribed a medication or treatment regimen without knowing what medications you are on, what would you call that?

Malpractice.

Why? Because, it’s not just about side effects. It’s about interactions.

When you put two or more drugs together, interactions can be deadly.

Same for your retirement plan.

When you have multiple financial and legal tactics at work, you need to rigorously test for negative financial and tax interactions.

Do you have a written outline of the side-effects and tactical interactions under your current plan, along with an outline of how they are being managed and minimized?

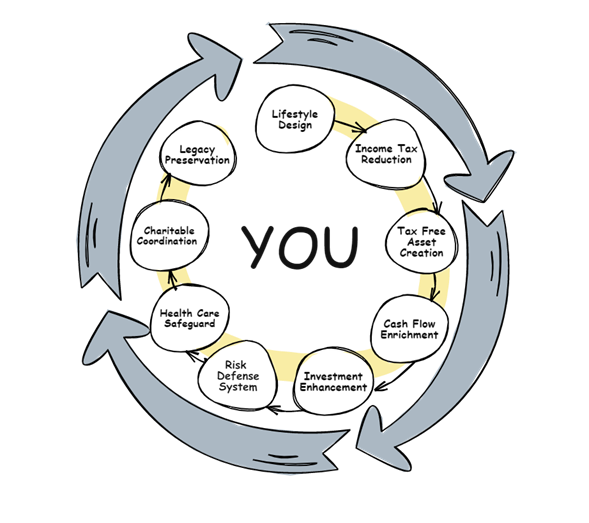

Side-effects and tactical interactions must be managed AND minimized in all your critical retirement areas:

My philosophy is very simple:

- YOU First;

- Taxes Last;

- Side Effects Least

About 2,500 years ago, Chinese military strategist Sun Tzu wrote The Art of War. In it, Tzu said, “Tactics without strategy is the noise before defeat.”3

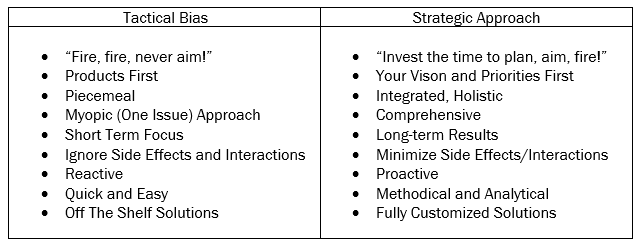

Plan strategically. Execute tactically.

What’s the difference?

86% Not Receiving Comprehensive Financial Advice

Amazingly, very few are receiving strategic and comprehensive wealth planning.

A J.D. Power Survey reports, “Of those clients “promised” comprehensive wealth planning by the giant wealth managers, 86% are NOT receiving comprehensive financial advice.” 4

Beware of a Product First approach to your retirement.

It’s called the The Law of the Hammer: "If all you have is a hammer in your toolbox, everything looks like a nail.” Bernard Baruch5

There are too many hammers out there masquerading as “retirement planning.”

So many are running around blindly searching for a “magic bullet” investment or financial product that will promise an extra percent return here and there, while leaving themselves open to be blindsided by unknown financial and tax interactions.

Wealth Myth #11: The Media Is Here to Help You Stay Wealthy

The media (especially so-called internet “advice”) is NOT here to help you.

Media needs advertising revenue to keep the lights on. Advertising revenue is based on eyes and ears – viewership, readership or listenership.

Every form of media needs you to KEEP watching, reading and listening, often appealing to fear, greed and envy and creating confusion to keep you tuning in.

In the Fortune magazine article, Trust in media is so low that half of Americans now believe that news organizations deliberately mislead them, they report that “Half of Americans in a recent survey indicated they believe national news organizations intend to mislead, misinform or persuade the public to adopt a particular point of view through their reporting… Only [1 in 4] 23% said that they believe national newsrooms care about the best interests of their audiences.”6

This is nothing new.

In 1807, statesman Thomas Jefferson wrote a letter complaining about the misinformation in newspapers: “Nothing can now be believed which is seen in a newspaper. The real extent of this state of misinformation is known only to those who are in situations to confront facts within their knowledge with the lies of the day.”7

That opinion was shared by Mark Twain, who would comment, “If you don't read the newspaper, you're uninformed. If you read the newspaper, you're mis-informed.”

I've given you 11 wealth myths over the last month and there is one important one left that I will share next week.

Retire Abundantly Quote

“Tactics without strategy is the noise before defeat.”

-Sun Tzu