These Wealth Myths That You May Have Missed May Be The Costliest…

Wealth Myth #8: The 401(k) Binge Myth

“Binge on your 401(k).” [Binge – a period of excessive or uncontrolled indulgence.]

They don’t say it that way.

They say everyone should “max out” their retirement monies – IRAs, 401(k) Plans, 403(b) Plans, SEP Plans, Profit-Sharing Plans, Defined Benefit Plans, Money Purchase Plans, 457 Plans.

Beware of “everyone,” “always,” and “never” advice. It’s one-size-fits-all advice.

“Everyone,” “always,” and “never” advice is never (well, rarely) correct!

Keep in mind, every tactic – whether financial, legal, tax, or medical – has side-effects. There are NO PANECEAS. No matter what advisors tell you.

Side effects are trade-offs. Sometimes worth it. Sometimes not.

One of the least disclosed side effects of “401(k) binging” is the loss of the favorable tax rates on capital gains.

The promised benefit of “get a tax deduction today by deferring the tax until retirement” comes at the cost of negatively converting your capital gains (lower taxer rate) into ordinary income (higher tax rate)… with the promise that ordinary income tax rates will be lower down the road.

The capital gains tax is a charge on the “profit” you receive from the sale of a capital asset that has grown. Capital gains are taxed at a lower marginal rate than ordinary income (see the chart)6.

All the capital growth INSIDE a retirement account loses this favorable tax treatment.

If you look at the S&P 500 over the 20-year span from 2003 to 2023, the annualized return with dividends reinvested is 9.9%. Without dividends reinvested, the S&P 500 grew 7.8% annualized.7

That means that 80% of the growth came from CAPITAL GROWTH.

That also means you lost the tax benefit on 80%.

Currently, the top income tax rate is 85% higher than the top capital gains tax rate. One-size-fits-all financial advice ignores this fact, often relying on Wealth Myth #9 as the justification.

They often ignore Wealth Myth #12 as well (more on that next time).

Wealth Myth #9: The Lower Tax Bracket Later Myth

One of the most widely believed myths (a sister myth to Wealth Myth #8) is… “You’ll be in a lower tax bracket in retirement than you’re in during your working years.”

This myth will be true… if… you significantly dial back your lifestyle.

The most SIGNIFICANT reason tax rates are most likely to go up (not down) is the historic Federal government overspending leading to crushing Federal debt.

When Grandma said, “Don’t spend what you don’t have,” she was likely quoting Thomas Jefferson, who said, “Never spend your money before you have it.”

Politicians operate like they’ve never heard Grandma’s, or Jefferson’s, advice.

For the first time since World War II, in 2020, the Federal government spent almost TWICE what they took in.9

Their OVERSPENDING didn’t stop in 2021 either.

Over that two-year period, the Federal government spent $5.9 trillion dollars MORE than they received in revenue.9

The BIGGER question is, “WHO will the Federal government turn to to repay their Mount Everest of debt?”

The answer? The “successful.”

You and me.

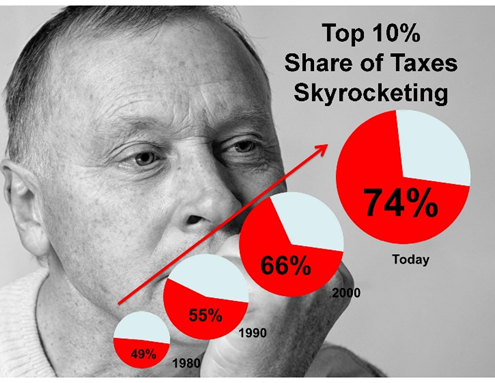

The top 10% of income earners — the “successful” — have always shouldered a large percentage of the tax burden. However, their share has increased dramatically, and they now pay the lion’s share of taxes.

In 1980, the top 10% shouldered 49% of the tax burden. By 1990, it was 55%. In 2000, it rose to 66%.10

The top 10% now shoulder 74% of Federal income taxes!

We are not talking about those who make millions either.

To be in the top 10%, you only need to have income over $173,000!11

How high will income tax rates go?

As high as the Federal government wants… or needs… to pay for THEIR overspending.

When President Ronald Reagan took office, the highest income tax rate was over 70%. In the decade before, the highest rate was 91%.

That’s not a misprint. It was 91 percent. For every dollar you earned, you got to keep 9 cents!

That’s why I always say, “You can make more money by saving taxes than you can by making more money!”

So many are running around blindly searching for a “magic bullet” investment that will generate an extra percent return here and there, while leaving themselves open to be blindsided by future increases in tax rates.

To me, every unnecessary dollar you surrender to the IRS needlessly is one less dollar you have for your lifestyle (and legacy).

You agree?

Nasty myths. Infectious to a healthy retirement, if untreated. Every one of these is avoidable.

If you’d like to see exactly how much these myths may be costing you in unnecessary taxes and lost lifestyle, let me walk you through our 21-Point Retirement Lifestyle Assessment.

Schedule your Retirement Confidence Conversation to uncover:

- Where your plan may be exposed

- How to reduce unnecessary taxes

- What you can do now to preserve your lifestyle and legacy

👉 It’s your life. Retire on YOUR Terms.

Schedule Your Private Briefing »